November 2025 - Bubble Talk on Trial

By: Kyle McBurney, CFP

Every investor, at some point, has whispered a version of the same prayer: “Please, Mr. Market, make me rational, but maybe next year.”

St. Augustine said it first, though with a bit more soul: “Please God, make me good, but not yet.” Over time, it’s become a motto for anyone balancing good intentions with guilty pleasures — gym memberships, desserts, and all.

But as historian James J. O’Donnell reminds us, Augustine actually wrote, “Oh Master, make me chaste and celibate, but not yet!”

It still sounds less like a saint and more like someone bargaining with a Roman bartender at last call for vino.

To close the month, the S&P 500 is up 16.3% this year. Per Morningstar, the index rose 2.3% in October, marking its sixth straight monthly gain, a truly remarkable run since the tariff-related tantrum. Unsurprisingly, the gains have been driven by a handful of tech stocks. After such a tremendous climb, investors are asking the inevitable question: can this really continue? Is A.I. forming the next great market bubble?

So, let’s talk about bubbles. The topic has surfaced in many recent client conversations, and even the most level-headed investors are starting to wonder. Of course, no one knows for sure. There’s no bell rung at the top. As Alan Greenspan once said, a bubble can only be recognized in retrospect. Until then, all we can do is watch for warning signs. Then again, cracks can always be found — even in the bulliest of bullish bull markets.

History gives some clues, but never full clarity. When we compare today’s Nasdaq 100 rally with the Roaring ’20s, Japan’s boom of the 1980s, and the dot-com surge of the 1990s, the echoes are hard to ignore. We haven’t hit the extremes of 1999, but we’re keeping pace with Tokyo in its prime. That’s not exactly comforting.

The fundamentals of the market remain solid.

This year’s rally has been powered more by earnings growth than by expanding valuations. Goldman Sachs Global Investment Research expect S&P 500 profits to rise by about 9% this year and 14% next, while small-cap earnings are also improving.

Market breadth is widening too. As noted by Bloomberg, more stocks are climbing, not fewer. When the S&P 500, Dow, and Russell 2000 all finish a month at record highs, that usually signals conviction — not FOMO. Global equities have also broken out to new highs, and even the Russell Micro Caps joined the party for the first time in years, per Morningstar Direct.

Still, we know how elevated things have become. If 2025 ends strong, it would mark three straight years of 20% gains for the S&P 500, something seen once before, in the late 1990s, as noted by Carson Research. Those markets kept climbing for a while, but we all remember how that story ended.

The good news? In our experience, bubbles rarely burst while everyone’s worried about them. They pop when the last skeptics finally give in and join the party, when caution gives way to greed.

So where does that leave us? Somewhere between confession and conviction, I suppose. The market’s strength is undeniable, but cautiousness is prudent. This is the time for intelligent profit-taking: trim the winners, rebalance toward quality, and remember that diversification isn’t penance, it’s preparation. You don’t have to renounce optimism, just practice moderation.

Or, as Augustine might tweet today: “Oh Market, make me diversified and disciplined, but not yet.”

Let the Trial Begin

Despite a few bumps in the road, the numbers remain eye-popping. One of 2025’s biggest surprises has been the comeback of international stocks, both developed and emerging. After years stuck in the slow lane, they’ve finally shifted into the passing lane. Emerging markets, especially, have stolen the spotlight, climbing 32% this year despite ongoing tariff uncertainty, per Morningstar Direct.

What’s fueling the rally? According to Strategas Research, a mix of cheaper valuations, a softer U.S. dollar, and a well-timed macro tailwind boosting corporate profits. In short, the global stage has its groove, and we’ve been leaning in as we head into ’26.

But lately, a different topic keeps surfacing in nearly every client meeting: bubbles.

The question —and the idea of “taking profits” — comes up repeatedly in recent conversations. It’s a fair one, and worth unpacking.

Markets have always fascinated me. Every day feels like a courtroom drama with the bull and the bear making their closing arguments, each trying to sway the jury. And truth be told, the bear case usually sounds smarter. Arguments for decline are always more sophisticated, more rational, even a bit seductive. Yet history tells a different story: depending on the time frame, markets rise roughly 70–80% of the time, per Bloomberg.

So perhaps a trial is just what we need.

Will the plaintiff please step forward and present their case to the jury?

We Are In a Bubble (Duh)

Your Honor, the evidence is overwhelming. The market stands accused of excessive optimism, reckless valuation, and ignoring economic reality.

Exhibit A: Valuations on Trial

Ladies and gentlemen of the jury, let’s start with the obvious. The market is expensive — again.

The S&P 500 now trades well above its long-term average price-to-earnings multiple are reported by J.P. Morgan. At these levels, investors aren’t just buying future profits, they’re buying perfection. Take a look at where valuations stand compared to 30-year averages:

Earnings growth has been strong, yes, but price momentum has outpaced fundamentals. It’s as if the market’s been promised eternal sunshine with no chance of rain. Or, as the distinguished financial sage Kyle McBurney once remarked: “How much better can better-er get?

History, of course, always delivers its verdict. Every era that insists “this time is different” ends the same way — with a humbling reminder that it isn’t. This recurring lesson is central to This Time Is Different: Eight Centuries of Financial Folly by Carmen M. Reinhart and Kenneth S. Rogoff.

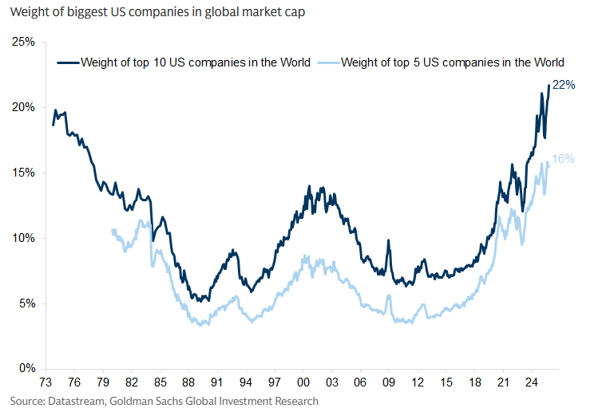

Exhibit B: Concentration Risk – The Usual Suspect

Let’s move to the second count: market concentration.

A handful of tech giants, names you can recite by heart at this point, are doing nearly all the heavy lifting. As reported by Goldman Sachs, the top ten stocks in the S&P 500 now make up almost a quarter of the world’s total market capitalization, a historically high level of concentration. Also, they’ve been responsible for the lion’s share of returns. According to JPMorgan, seven companies accounted for roughly 55% of last year’s gains. That’s like a jury where ten people do all the deliberating while the other 490 just nod along (no offense to present jury).

Simply put, when leadership narrows, risk widens. This isn’t diversification — it’s market dependence, which can work against investors quickly. If even one of these mega cap names trip, the whole index catches a cold.

Sure, innovation drives growth. But innovation is not immune to gravity, and, as I have learned on the slopes, gravity always wins in the end.

Exhibit C: Economy Under Cross Examination

And finally, let’s talk about the broader economy.

Job growth has cooled, wage gains are uneven, and consumer savings from the pandemic are largely spent, per Federal Reserve Bank of Chicago. Inflation has come down, but not out. Also, there is still plenty of uncertainty around tariffs and the ongoing government shutdown. Speaking of employment, the numbers from the Chicago Fed show a disturbing trend:

The Fed, meanwhile, continues its delicate balancing act — keeping rates high enough to fight inflation, but low enough to avoid tipping the economy into recession. It’s a tightrope walk with no safety net.

In our opinion, corporate profits, for their part, can’t keep defying economic gravity forever. Even a mild slowdown tends to catch up with sentiment eventually, and markets don’t stay patient for long.

So, ladies and gentlemen of the jury, the case is clear:

In our view, valuations have run ahead of reason. Gains are concentrated in a narrow few. And the economy, though still standing, is starting to wobble under the weight of uncertainty and weary consumers.

The Case for the Defense

Before we deliver a verdict, the defense would like a word. Because while the prosecution makes a strong case for caution, the evidence isn’t all one-sided.

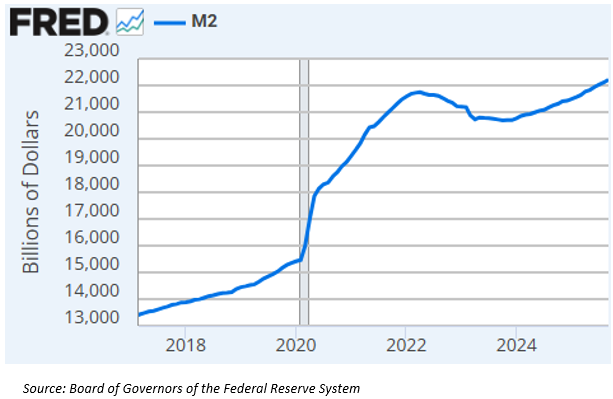

Exhibit D: The Matter of Money Supply

First, ladies and gentlemen of the jury, let’s discuss money supply. Sometimes the market really is that simple: more money in the system, and asset prices tend to rise. We saw this movie after Covid, liquidity surged, and so did markets. Then came 2022, when the tide went out, and valuations followed.

Today, the tide is turning once again. Liquidity is rising.

For the record, the Federal Reserve divides the nation’s money supply into two key measures: M1 and M2. M1 covers cash and checking deposits, the money that moves every day. M2, the broader gauge, includes M1 plus savings accounts and money markets, the funds that fuel broader financial activity.

And as the evidence shows, after a stretch of tightening, the Fed has quietly lifted its foot off the brake. Global central banks, too, are leaning in the same direction. Money, as any good economist will tell you, is the oxygen of markets. And as long as it’s flowing freely, asset prices — though not guaranteed — tend to breathe a little easier.

Exhibit E: Rate Cuts. Period.

Now, members of the jury, let’s turn to interest rates: the lever that can make or break a market cycle.

The market continues to debate the Fed’s next move. According to CME’s FedWatch tool, there’s a 70.1% probability that the Fed will cut rates again in December. Inflation has cooled from its feverish peak, and growth, while steady, is showing signs of fatigue. That gives the Fed room, and perhaps reason, to ease policy in the months ahead.

In our experience, history tells us what tends to follow: lower borrowing costs, renewed business investment, and a little more wind in the market’s proverbial sails. Rate cuts don’t guarantee smooth sailing, but they do tend to extend the runway for expansion.

Historical data indicate that, in previous cycles, markets often performed strongly when monetary easing coincided with sustained growth. According to Ryan Detrick of Carson Investment Research, when the Federal Reserve begins cutting rates near an all-time market high — as it did at the end of October — the S&P 500 has delivered positive returns one year later in 100% of observed cases. That’s not a cherry-picked data point, either; the pattern holds across 21 separate instances since 1980. Of course not a guarantee, but noteworthy information for the jury.

Pretty, pretty, pretty good (Larry David voice).

The prosecution may argue that high rates have often strained the system, while the defense notes that periods of relief have historically followed. When the cost of capital has fallen in the past, valuations have tended to rise, confidence has improved, and even cautious investors have found reason to stay engaged. The Fed has long walked a fine line, and history shows that when policy has tilted toward stimulus, markets have usually taken notice.

Exhibit F: The Psychology of Bubbles

And finally, members of the jury, let’s address the charge that we’re living in a bubble.

Bubbles, by their very nature, thrive on euphoria — on unshakable confidence that prices can only go higher. But that’s not what our team sees today. This market, for all its strength, is met not with mania, but with skepticism. Every rally is doubted. Every gain is questioned. And when everyone’s watching for the bubble, it rarely bursts on cue.

For context, CNN’s Fear & Greed Index reached “Extreme Fear” levels in early November. In the same period, the AAII Investor Sentiment Survey (week ending November 4, 2025) reported bearish sentiment at 52.9% and bullish sentiment at only 23.1% — a clear indication of widespread caution among investors.

Think back to true manias: the late 1990s tech boom, the mid-2000s housing frenzy. In those days, optimism drowned out caution. Remember the phrase, real estate never goes down?

Today, it’s the reverse. Fear still fills the courtroom — inflation fears, rate fears, valuation fears. Yet markets keep advancing, step by step, climbing that very wall of worry. This is normal after all.

This may not reflect irrational exuberance. It can be seen as resilience — an acknowledgment by the market that conditions are not ideal, yet they are not in a state of collapse either.

Ladies and gentlemen of the jury, if history teaches us anything, it’s that bubbles rarely pop when everyone’s testifying about them. Sometimes, the crowd’s anxiety is the very reason the rally continues.

So, ladies and gentlemen of the jury:

Yes, the market is exuberant. But irrational? Not yet.

Earnings are real. Innovation is real. The expansion of global growth is real. Caution is wise and prudent, but fear is unwarranted. After all, Investing has always been an act of optimism — a belief in progress, resilience, and reinvention.

Your Honor, the defense rests.

Verdict

Judge: Order in the court. Has the jury reached a verdict?

Foreperson: Your Honor… we have not.

After days of deliberation, the jury remains split. Half see a bubble ready to burst; the other half see a market poised for growth. In other words, the verdict is hung — the market remains both guilty and innocent, depending on your conviction.

Judge: Very well. Then this court will enter no judgment today. But as presiding judge, I’m entitled to offer a few observations…

Sometimes, the simplest explanation really is the best one. William of Ockham — to bring in yet another Theologian into the newsletter — taught that when faced with competing theories, the simplest is usually correct. You might recall this as Occam’s Razor.

Applied to today’s markets, William of Ockham might say: if money keeps flowing into the system, interest rates are expected to fall, and global growth is broadening, maybe we don’t need a conspiracy to explain why stocks keep rising.

That doesn’t mean the market is immune from turbulence, or that investors shouldn’t be careful at elevated levels. Profit-taking and rebalancing remain the sensible course, and is unique to each client.

So perhaps the jury’s stalemate isn’t such a bad thing. The bulls and bears can keep arguing their cases, but the simplest verdict may be this: the market is strong until it isn’t, and diversification will win the day.

Chart of the Month: Who would have guessed this 20 years ago?! A strong reminder of not trying to predict the future. It will be interesting to see what this does to healthcare and the food industry.

Reminder of the Month: Markets are in what has historically been the best three-month period of the calendar year (Nov, Dec, Jan).

November Allocation Update

Speaking of seasonality, according to Carson Research, markets have just navigated what is typically the choppiest stretch of the calendar with surprising ease. Portfolios benefited from healthy exposure to risk assets, both domestic and international, as investors were rewarded for staying the course.

We continue to believe that a diversified and disciplined allocation is the best approach in a market that cannot decide whether it is euphoric or exhausted.

After such strong runs in certain corners, particularly technology and gold, we’ve taken the opportunity to trim gains and rebalance toward quality. Profit-taking isn’t pessimism; it’s cautiousness. It’s how you turn momentum into preservation in case things turn fast.

We are also maintaining a healthy respect for fixed income. Bonds have had a solid year, with the Barclays Agg Bond Index up 6.8% (per Morningstar Direct), but we remain mindful that central banks still hold the steering wheel. If the Federal Reserve pivots faster than expected, especially for inflationary reasons, bond prices could give some back. If not, today’s higher yields continue to reward patience. Either way, balance matters, particularly when the rate narrative can shift after just a single hot inflation report.

On the equity side, we’ve found opportunity beyond U.S. borders. International and emerging-market stocks have reclaimed leadership in 2025, per Morningstar Direct, fueled by cheaper valuations, a softer dollar, and improving global growth. While we remain careful, we view global diversification as more than a box to check, it could be a source of return potential.

Lastly, we are holding extra dry powder as we approach 2026, a midterm election year. Historically, according to Strategas, year two of the presidential cycle tends to be more volatile. Markets dislike uncertainty, and politics always supply plenty of it. Fortunately, money markets are still providing decent yields, a benefit while maintaining flexibility on the sidelines.

For now, our playbook remains the same: stay balanced, stay patient, and stay prepared. The market may debate endlessly between boom and bust, but discipline has a way of winning the case over time.

Equities – Balanced:

International Balance: Well balanced, as global stocks continue to deliver. Valuations remain attractive and the weaker dollar continues to provide momentum.

Emerging Markets: The beleaguered index has jumped 32% in ’25. Is this the start of a new cycle?

Fixed Income – Underweight:

Core Bonds: We are looking at locking in yields where appropriate. Will add if economic data shows slowing growth.

Floating-rate Bonds and CLOs: Despite declining yields, these floating rate vehicles can still provide above average income and hedge in case of inflationary shock.

Alternatives – Overweight

Gold Overweight: Gold continues to perform well and serves as a nice hedge against inflation/dollar risk. We may be opportunistic if gold prices decline.

Growing Interest in Private Alternatives: We continue to explore private investments where appropriate, based on client needs and market access.

Cash – Slight Overweight

Strategic Use of Cash: Cash continues to offer valuable stability and flexibility while still delivering yields ~4% (as of 10.31.25)

Well, its that time of year.

For those on the Trail Guide’s illustrious distribution list, you’ve probably seen our family’s Halloween photo. It’s a doozy. Cooper and Teddy went as Dragon Riders, Heather was a lion (simplicity is survival with three kids), and baby Ellie made her debut as the world’s cutest tomato. Ellie continues to melt hearts.

And that towering green figure in the back? Yes, that’s yours truly in an utterly ridiculous Hulk costume. For the record, Cooper, our charismatic three-year-old, pleaded/begged/demanded that we both be the Hulk this year. Great idea, I thought!

But did that happen? It did not (narrator voice).

In what’s becoming a Halloween tradition, he changed his mind the day of. Last year I was a zookeeper with no tiger; this year, a lone Hulk wandering the suburbs. But I’ll admit, the costume was pretty great. It even had a built-in fan, so all that muscle was just circulating cool air (hopefully not a market analogy).

It was fun being so massive… if only for one night. I can hear St Augustine now - Oh master, make me normal size, just not yet!

As we trade costumes for casseroles, I want to wish you and your family a warm and joyful Thanksgiving. Our team feels incredibly grateful to be part of your journey. Markets will always bring curveballs, but we’re always here to talk them through.

As always, thank you for your support and readership.

Kyle M. McBurney, CFP®

Managing Partner

CRN202809-9825533

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Supervisory office: 280 Congress Street, Boston, MA 02210. (617)-439-4389. Highland Peak Wealth is not a subsidiary or affiliate of MML Investors Services, LLC or its affiliated companies. Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. This material does not constitute a recommendation to engage in or refrain from a particular course of action. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index.

Glossary of Index Definitions

Indexes are unmanaged, do not incur fees or expenses, do not reflect any deduction for taxes, and cannot be purchased

directly by investors.

The S&P 500® Index is a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

The S&P Muni Bond Index is a broad, market value-weighted index that seeks to measure the performance of the U.S. Municipal bond market.

Dow Jones Industrial Average is a price-weighted average of 30 actively traded Blue Chip stocks, primarily industrials, but also including other service-oriented firms; may be used as a benchmark for large cap stocks

NASDAQ Composite is a broad-based index of over 3,000 companies, which measures all domestic, and non-U.S.-based common stocks listed on the NASDAQ Stock Market, Inc.

The NASDAQ 100 U.S. Index is a composed of the 100 largest, most actively traded U.S. companies listed on the Nasdaq stock exchange.

The Russell 2000® Index is a widely recognized, unmanaged index representative of common stocks of smaller capitalized U.S. companies.

The MSCI EAFE Index is a widely recognized, unmanaged index representative of equity securities in developed markets, excluding the U.S. and Canada.

The MSCI Emerging Markets (EM) Index is an unmanaged market capitalization-weighted index of equity securities of

companies domiciled in various countries. The Index is designed to represent the performance of emerging stock markets

throughout the world and excludes certain market segments unavailable to U.S.-based investors.

The MCSI All Country World Index (ACWI) captures large and mid cap representation across 23 Developed Markets and 24 Emerging Markets.

The Barclays U.S. Aggregate Bond Index is a broad measure of the U.S. investment-grade fixed-income securities market.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of fixed-rate investment-grade securities with at least one year to maturity, combining the Bloomberg U.S. Treasury Bond Index, the Bloomberg U.S. Government-Related Bond Index, the Bloomberg U.S. Corporate Bond Index, and the Bloomberg U.S. Securitized Bond Index.

The Nikkei Index is a price-weighted index composed of Japan’s top 225 blue-chip companies traded on the Tokyo Stock Exchange.

©2025 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its

content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information