January 2026 - Journey Ahead

By: Kyle McBurney, CFP

Managing Partner at Highland Peak Wealth

2025 was a Journey year. Not the literal kind, but very much the “Don’t Stop Believin’” variety. We sampled every flavor of risk the market buffet had to offer. DeepSeek and AI risk? Check. War? Still there. Tariffs? Check. Government shutdown? Record-setting check. Market correction? Oh yes. And somehow, as if Journey was playing on repeat, markets still delivered a double-digit return for the third year in a row.

And 2026? Already painfully boring. So dull. I joke, of course. More on that later.

Writing this on a quiet, snowy day, what continues to surprise me is just how much gloom and doom that accompanied last year’s continued gains. Some have called this the most hated bull market of all time. I’d argue the 2010s rally still holds the platinum record for market skepticism, but this one is gaining ground.

The truth is perception and reality often drift apart in financial markets. Even with markets providing another superb year, investors today remain stubbornly gloomy, more pessimistic than during the Global Financial Crisis, the early 1990s recession, or even the pandemic. Headlines, social media, and political noise make optimism a challenge, even when things are, economically speaking, going reasonably well.

I urge readers to step back from the noise. The fundamentals tell a much calmer, more optimistic story:

Household balance sheets are strong

Net worth relative to disposable income sits near all-time highs

Corporate earnings remain strong globally

Money supply continues to grow (St. Louis Fed)

Unemployment is still low in historical context

Inflation has retreated from its peak

Don’t Fight the Fed

Economic growth? A 5 percent fourth quarter read should not be a surprise (per Atlanta Fed)

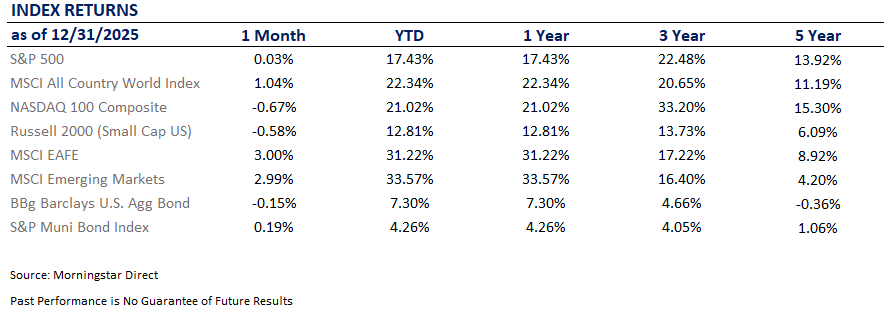

Add it all up, and the S&P 500 finished up 17.4% percent last year, marking a third straight year of double-digit returns (Per Morningstar). The tech-based Nasdaq continued its historic rise, gaining 21%.

One of the underappreciated stories of 2025 was just how well diversification worked. International stocks delivered their strongest relative performance in years. Emerging markets surprised to the upside. Gold continued to shine. Fixed income generated equity-like returns, driven more by income than falling rates. Even within equities, leadership broadened well beyond a narrow group of names. Like the hokey pokey, it wasn’t all about the Magnificent Seven! (I reused joke here)

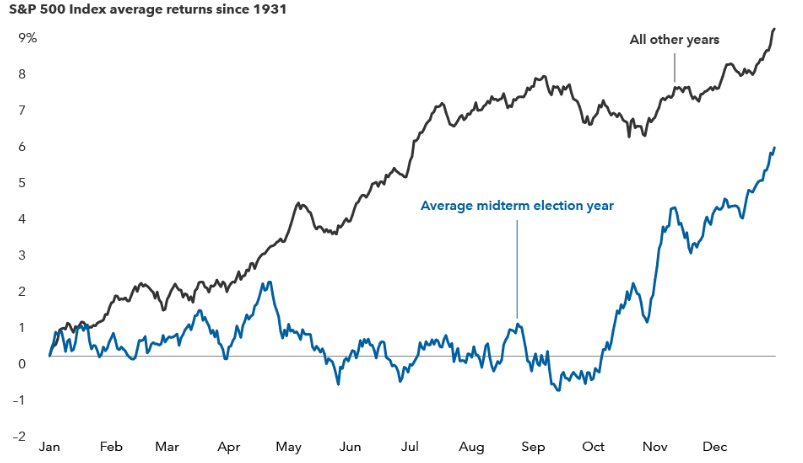

Looking ahead, 2026 will have its own flavor of risk and opportunity. Midterm election years have historically added volatility, but that is not a reason for fear. It is a reason to stay disciplined. Markets rarely move in straight lines, and trying to predict every twist matters less than being prepared and flexible.

And, of course, life goes on outside the markets. This year it spins a ball too. The World Cup comes to the U.S., proving that some domestic booms come from corner kicks and phantom offsides, not just AI buildouts.

Our mantra heading into the new year is simple: stay balanced as market leadership broadens, focus on data over noise, and lean into diversification. International markets are increasingly compelling, offering growth and portfolio resilience. The lesson is to trust the process, enjoy the ride, and as Journey reminds us, hold on to that feeling of momentum and discipline.

2026 Outlook

This is likely what you are looking for, no? I don’t think you come for my jokes, as stellar as I find them to be.

In many ways, nothing has changed. We see plenty of growth against a backdrop of expensive stock prices and noteworthy valuations. Will this be the year the A.I. bubble pops? It could be. Could we see a market correction or bear market? Sure, but when isn’t that the case, especially when mid-term elections are involved?

Twist our collective arms and our team begrudgingly admits that through it all, we still feel confident moving into the new calendar year. And, as early ’26 trading suggests, we are not alone.

So, what’s actually supporting this market beneath the surface?

Liquidity Still Positive

Zooming out, the macro backdrop remains upbeat.

Per the St.Louis Fed, money supply (M2) continues to grow. M2 is simply all the money sloshing around the system—cash, checking accounts, savings, you name it. And when that pool gets deeper, it usually doesn’t stay on the sidelines. Historically, excess liquidity has a habit of finding a home, and markets tend to be one of the beneficiaries.

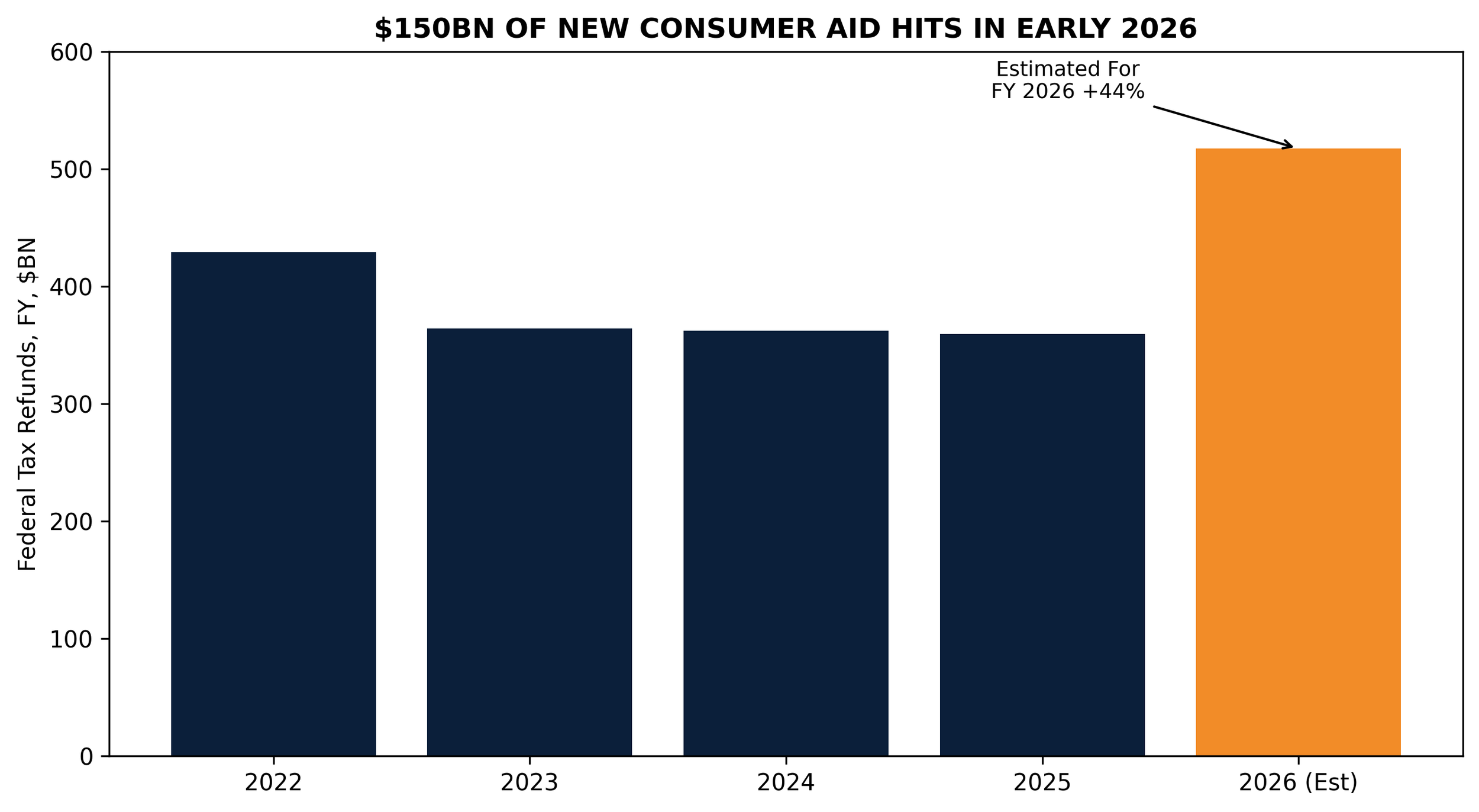

This spring adds an interesting wrinkle. Thanks in part to the OBBBA —yes, the Big Beautiful Bill— tax refunds are expected to be unusually large. According to Strategas, refunds could top $500 billion. That’s not a rounding error. That’s real cash showing up in real bank accounts, and it tends to get spent, saved, or invested.

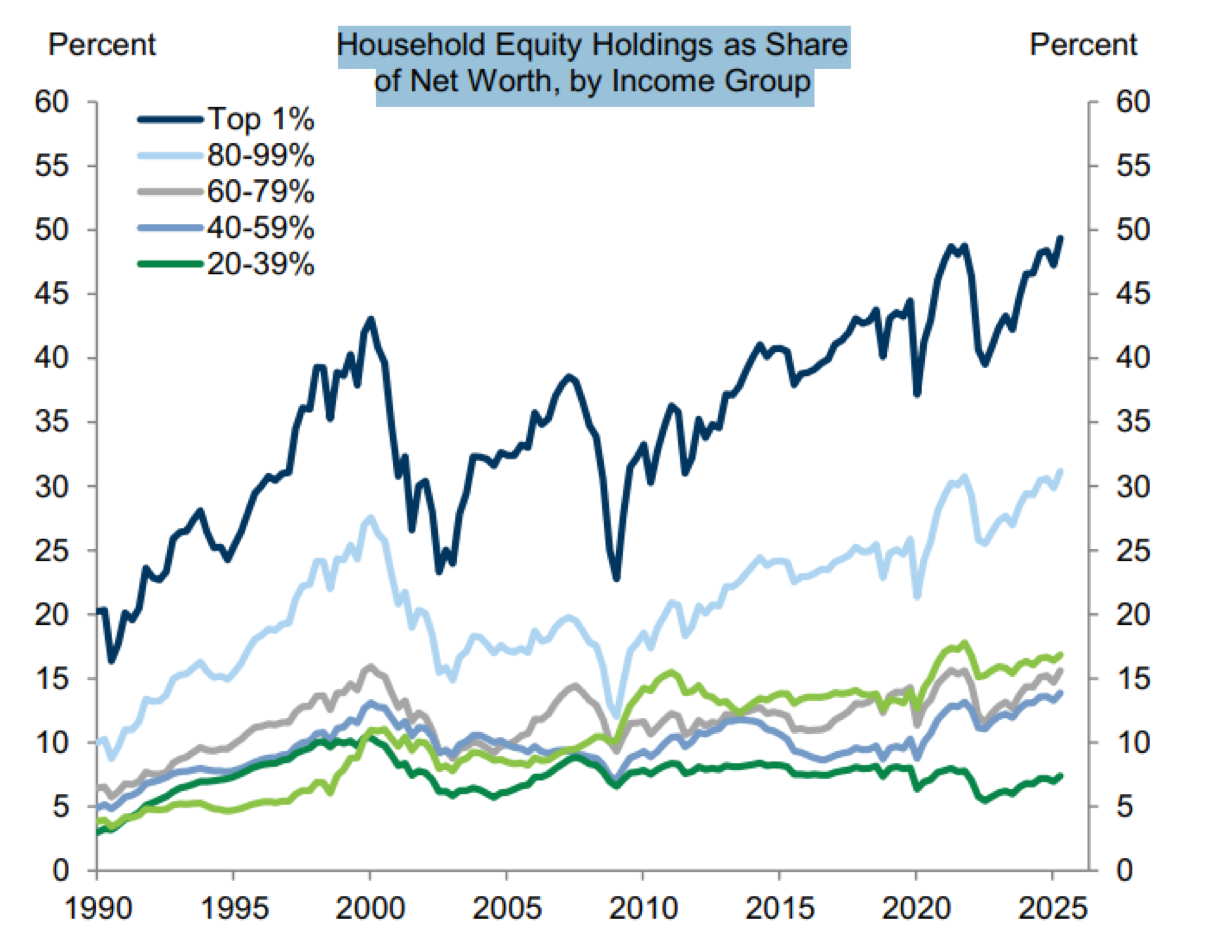

Household fundamentals remain in good shape as well. Balance sheets are healthy, net worth relative to disposable income is sitting near all-time highs, and unemployment—although no longer improving—is still low by historical standards. In plain English: the wealth gap is hard to ignore (not OK), but more are at least participating.

The chart above reinforces the point. Market participation has expanded across all income groups, not just at the top. That broader ownership base strengthens balance sheets, supports confidence, and adds durability to consumer spending. And from a market perspective, that’s exactly the kind of liquidity backdrop you want working in the background.

Corporate Earnings Still Strong

We all know where valuations stand as we head into the new year. There’s no sugarcoating that. So, if the market is going move up in 2026, earnings will need to do most of the talking—and a fair amount of the heavy lifting.

An encouraging part? The quality of this rally has steadily improved. Back in 2023, most of the gains came from multiple expansion; investors paying more and more for the same dollar of earnings. In 2024, things started to even out, with returns split between higher valuations and actual earnings growth. By 2025, earnings took the wheel, accounting for the bulk of market gains.

That’s exactly the progression you want to see. In our world, this is what a “healthier” market looks like. And after the last few years, who among us isn’t aiming to be a little healthier in ’26?

Corporate America deserves credit here. Companies have quietly done the unglamorous work, protecting margins, controlling costs, and squeezing more juice out of the productivity berry. Technology spending, particularly around AI and automation, hasn’t just made for flashy headlines. It’s translated into real efficiencies and real profits across a wide range of industries.

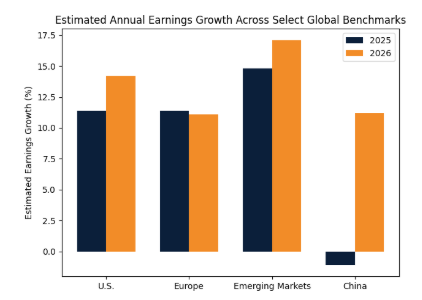

And it’s not just a U.S. story. Earnings growth is improving globally as well, which matters more than it gets credit for, especially in a market that’s searching for breadth, durability, and a little less reliance on the same familiar names.

Source: Capital Group, FactSet, MSCI, S&P

Looking ahead, analysts are penciling in double-digit earnings growth, per analysts at Goldman Sachs. Maybe that happens. Maybe it doesn’t. High single-digit growth feels like a more reasonable place to set expectations.

In a market with elevated valuations, earnings don’t need to steal the show or blow the doors off expectations. They just need to show up on time, do their job, and avoid causing any surprises.

Boring? Maybe. Effective? Absolutely.

In markets, boring tends to age pretty well.

Optimism Around Emerging Markets

If diversification quietly did its job in 2025, emerging markets may be ready for a more visible role in 2026.

After spending years in the penalty box, these markets are finally catching a few breaks at the same time. A weaker U.S. dollar is helping global returns, commodity prices remain supportive, and domestic reforms in places like Brazil, India, and parts of Asia are starting to show up where it counts: in growth and earnings.

What’s different this time is that emerging markets aren’t just bouncing back because the cycle turned. In many cases, they’re benefiting from real, structural improvements. Better fiscal discipline, regulatory reforms, and shifting global trade dynamics are laying a sturdier foundation than we’ve seen in years. Many of these markets posted double-digit returns in 2025, and while timing is never precise, the fundamentals suggest this story may still have room to run.

The bigger takeaway is simple: global diversification isn’t just a defensive move. It’s an opportunity set. By looking beyond U.S. equities, investors can participate in growth where it’s still developing, not just where it’s already been priced in.

And sometimes, the most interesting stories are the ones that took a little longer to get started.

Midterm Election Scaries

We’re heading into the midterm year, historically the market’s least favorite stretch. Weakness doesn’t usually show up right away. More often, it creeps in late Q1, hangs around through spring and summer, and then fades as fall rolls around.

Source: Capital Group, Rimes, S&P

Even as recently as 2022—the last midterm year—the October rally above was significant. This is good to keep in mind if markets battle midyear volatility. As always, the point here isn’t prediction, but preparation. History isn’t a rulebook, but it helps put patterns into perspective. So instead of guessing, we watch the tape. When leadership starts to crack, it usually shows up first in the market’s “offensive” sectors—tech, financials, industrials, and consumer discretionary. So far, we’re not seeing any cracks.

For now, we stay flexible, stay alert, and remember that a midterm year tends to test patience . . . right before it rewards it. The year ’22 was a perfect example.

Geopolitics: Hard to Ignore

Let’s briefly stay in the political lane for one more moment. The headlines are loud, opinions are plentiful, and market assumptions are flying around as usual.

That said, it’s early. Outcomes are still highly speculative. And so far, markets have mostly shrugged. Equities kicked off the year on solid footing, and even as events unfolded. Bitcoin, which trades 24/7 and tends to react first, barely flinched.

Oil, however, has noticed.

Given Venezuela’s sizable reserves, it doesn’t take much imagination to see why energy markets would react. As of January 8th, per Koyfin, crude oil is up about 3.3%, Brent is up roughly 2%, and energy stocks are higher by just over 4%. This reaction is not nothing, but it is also not exactly panic-inducing.

The long-term question is whether more oil ultimately helps or hurts markets. It’s a balancing act. Lower oil prices are great for consumers, but tough on energy companies and employment if wells shut down and capital spending dries up. And while Big Oil doesn’t win many sympathy votes, large layoffs tend to ripple through the broader economy.

We’ve seen this movie before. Back in 2015, when oil collapsed below $40 a barrel, markets didn’t celebrate as stocks fell more than 10% as energy layoffs piled up and credit stress spread. Cheap oil can be a gift, but when it comes too fast, it can create just as many problems as it solves.

For now, this looks like a data point, not a derailment. Worth watching. Not worth trading.

Reminder of the Month:

If magazine covers were reliable signals, investing would be a lot easier. Instead, the U.S. dollar quietly slid nearly 10% last year, per Bloomberg. Enjoy the art, ignore the advice.

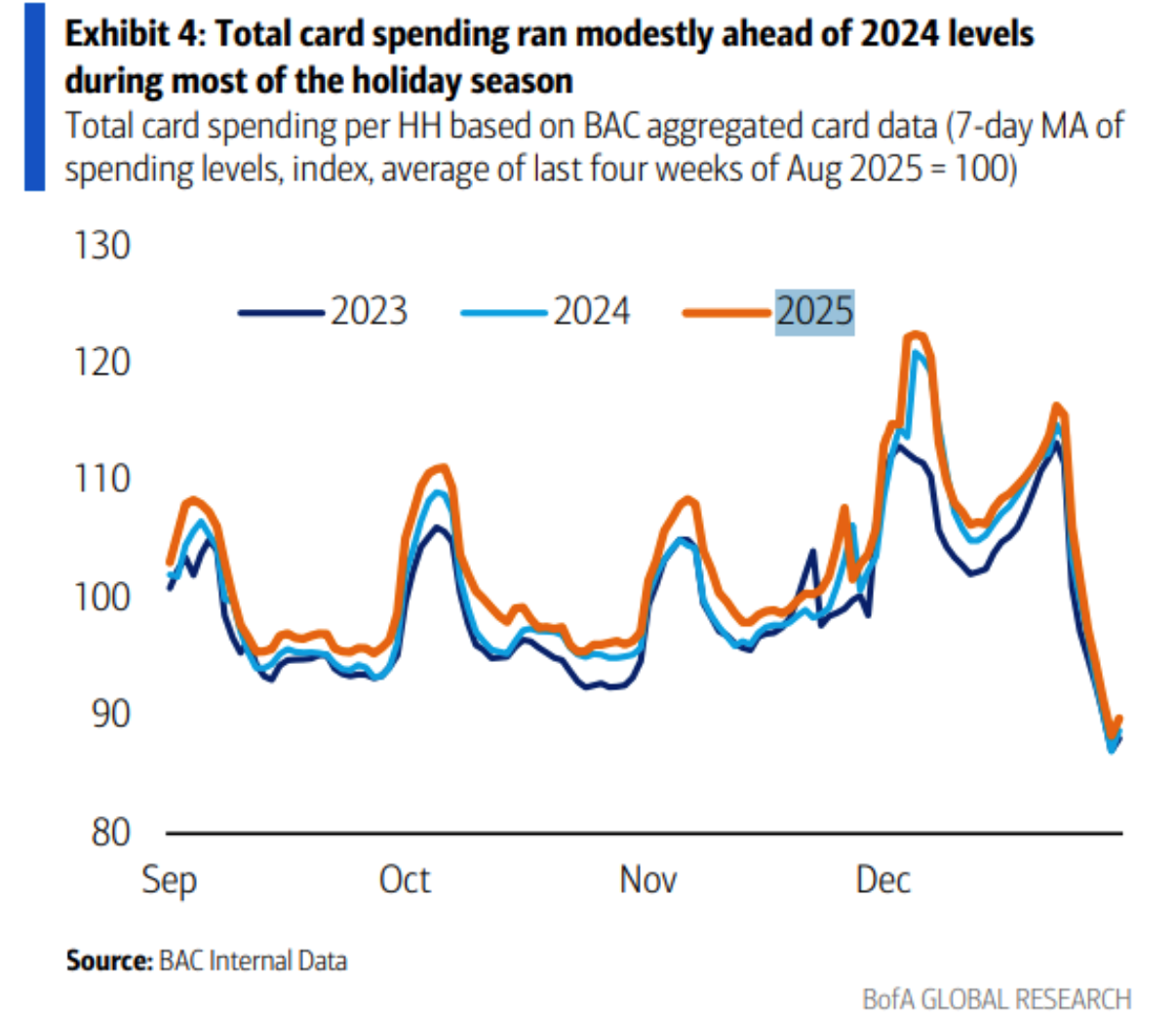

Spending Check In:

Something about Mark Twain…demise…and the U.S. Consumer.

January Allocation Update

At a high level, we continue to feel good about equities. We are not all in, but we are also not hiding under the desk. The earnings backdrop, improving market breadth, and still-supportive liquidity environment give us enough confidence to stay constructively invested. That said, where we are positioned within equities matters now more than ever.

International stocks, particularly emerging markets, continue to have our attention. After spending years on the sidelines, they have come out of the gate strong in 2026, helped by a weaker dollar, improving fundamentals, and better earnings expectations. For the first time in a while, it feels like momentum is here.

U.S. small caps are another area we are watching closely. With rate cuts on the horizon and a strong start to the year, the setup is improving. In fact, per Koyfin, small cap stocks have quietly outperformed their larger peers by 5.6% over past six months.

On the more defensive side, bonds are doing what bonds are supposed to do. We are slightly underweight, primarily because our preference remains with risk assets. Gold continues to act as a useful hedge, however, especially as geopolitical noise picks up.

Zooming out, as market leadership broadens and gains spread beyond Big Tech, diversification is quietly doing what it has always done best. It reduces risk, smooths out the ride, and opens doors to opportunity.

The benefits of diversification are, well… diverse. I’ll accept my Pulitzer anytime now.

As always, here is our current snapshot:

Equities – Balanced:

International Tilt: Well balanced, as global stocks continue to deliver. Valuations remain attractive and the weaker dollar continues to provide momentum.

Emerging Markets: Already leading the charge in 2026.

Fixed Income – Underweight:

Core Bonds: We are looking at locking in yields where appropriate. We will add if economic data shows slowing growth.

Floating-rate Bonds and CLOs: Floating rate vehicles can still provide nice income and hedge in case of inflationary surprise.

Alternatives – Overweight

Gold Overweight: Gold continues to perform well and serves as a nice hedge against inflation/dollar risk.

Growing Interest in Private Alternatives: We continue to explore private investments where appropriate, based on client needs and market access. More on this in ’26.

Cash – Slight Overweight

Strategic Use of Cash: Some cash remains on the sidelines for opportunistic purposes.

As many of you kindly reminded me last month, the holidays with young kids are a true cocktail of magic and pure mayhem. Equal parts joy and chaos. The Elf on the Shelf, for example, became a nightly event and a test of parental creativity. Dubbed “Darey,” our magic elf found himself in increasingly daredevil situations each morning. Hanging from the ceiling fan? Sure. Dangling from the highest point of the ceiling? Why not.

It’s a miracle yours truly survived. At one point I was standing on a chair on top of a table. The things we do!

We also squeezed in some skiing in Vermont, where the conditions were icy and humbling, especially for a lumbering Dad. Teddy approached the mountain slowly and thoughtfully. Cooper, on the other hand, went full steam ahead, damn the torpedoes. Our family demonstrates an ideal mix of risk tolerance and investor personas on the same slope. And Ellie, now nearly ten months, remains perfect and just thrilled to be part of the craziness.

She’s just a small town girl, after all.

Cheers to a fantastic year ahead. Onward we go. As always, thank you for your support and readership.

Kyle M. McBurney, CFP®

Managing Partner

CRN202901-10223335

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Supervisory office: 280 Congress Street, Boston, MA 02210. (617)-439-4389. Highland Peak Wealth is not a subsidiary or affiliate of MML Investors Services, LLC or its affiliated companies. Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. This material does not constitute a recommendation to engage in or refrain from a particular course of action. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index.

Glossary of Index Definitions

Indexes are unmanaged, do not incur fees or expenses, do not reflect any deduction for taxes, and cannot be purchased

directly by investors.

The S&P 500® Index is a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

The S&P Muni Bond Index is a broad, market value-weighted index that seeks to measure the performance of the U.S. Municipal bond market.

Dow Jones Industrial Average is a price-weighted average of 30 actively traded Blue Chip stocks, primarily industrials, but also including other service-oriented firms; may be used as a benchmark for large cap stocks

NASDAQ Composite is a broad-based index of over 3,000 companies, which measures all domestic, and non-U.S.-based common stocks listed on the NASDAQ Stock Market, Inc.

The NASDAQ 100 U.S. Index is a composed of the 100 largest, most actively traded U.S. companies listed on the Nasdaq stock exchange.

The Russell 2000® Index is a widely recognized, unmanaged index representative of common stocks of smaller capitalized U.S. companies.

The MSCI EAFE Index is a widely recognized, unmanaged index representative of equity securities in developed markets, excluding the U.S. and Canada.

The MSCI Emerging Markets (EM) Index is an unmanaged market capitalization-weighted index of equity securities of

companies domiciled in various countries. The Index is designed to represent the performance of emerging stock markets

throughout the world and excludes certain market segments unavailable to U.S.-based investors.

The MCSI All Country World Index (ACWI) captures large and mid cap representation across 23 Developed Markets and 24 Emerging Markets.

The Barclays U.S. Aggregate Bond Index is a broad measure of the U.S. investment-grade fixed-income securities market.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of fixed-rate investment-grade securities with at least one year to maturity, combining the Bloomberg U.S. Treasury Bond Index, the Bloomberg U.S. Government-Related Bond Index, the Bloomberg U.S. Corporate Bond Index, and the Bloomberg U.S. Securitized Bond Index.

The Nikkei Index is a price-weighted index composed of Japan’s top 225 blue-chip companies traded on the Tokyo Stock Exchange.

©2025 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its

content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information