June 2025 - Lasso Optimism

By: Kyle McBurney, CFP

Managing Partner at Highland Peak Wealth

Any Ted Lasso fans out there? It's a favorite show in the McBurney household and for good reason. What started as a goofy SNL skit and NBC Sports Ad series for the Premier League, became must-watch television that somehow managed to make us all believe in the power of relentless optimism.

Ted Lasso’s real strength wasn't his soccer knowledge— he comically had none. Instead, it was his ability to stay cheerfully positive, even when facing seemingly impossible challenges. Through chaotic seasons and skeptical players, his unwavering optimism and curiosity always moved the team forward. He famously kept a simple sign above his office door: Believe.

Markets lately seem to be channeling their inner Coach Lasso. Despite ongoing uncertainties—trade tensions, political upheaval, and economic volatility—investors have embraced optimism. Wall Street is believing the worst of the trade war is in the rearview mirror.

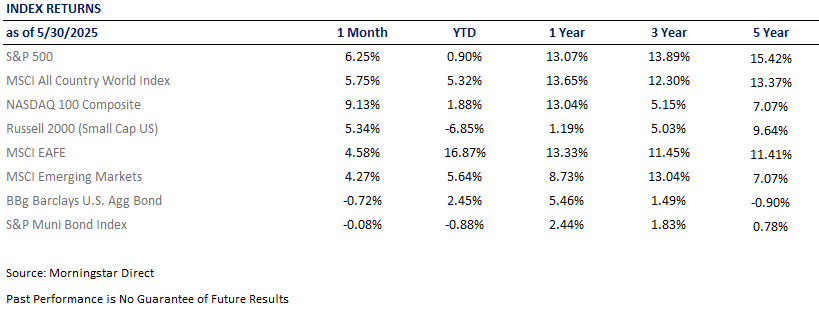

The numbers tell an impressive story. May was an impressive month for major indices: the Nasdaq 100 soared 9.13%—its best month in recent memory. The S&P 500 climbed 6.3%, its strongest performance since November 2023. Even the typically steady Dow increased a respectable 4.09%.

For the year, despite all the volatility, the S&P 500 finished Friday essentially flat at 1.06%, wrapping up what's been a significant winning streak. The Nasdaq also positive up 1.88%, while the Dow is down 0.14%.

Not everyone is embracing this newfound, Lasso-like optimism. One of the loudest—and most respected—voices of caution came from JPMorgan's Jamie Dimon. Fears over trade war fallout remain just below the surface. On Friday, Dimon implored Washington to resolve its differences with other governments, particularly China. "They're not scared, folks," he said about China. "We have to get our act together and we have to do it very quickly."

His bigger worry? "What I really worry about is us," Dimon added. He feared that high U.S. deficits mean "you are going to see a crack in the bond market."

He's got a point. Bonds last month fared far worse than stocks. Per Bloomberg, the benchmark 10-year Treasury yield rose nearly a quarter point to 4.418% in May as traders scrutinized the president's multitrillion-dollar fiscal package. Moody's stripped U.S. debt of its triple-A rating, citing the government's towering debt pile, and tepid demand at a May 21 Treasury auction added to a growing list of concerns.

On the stock side, earlier concerns have not gone away. Valuations remain historically high. The Price-to-Book ratio currently mirrors levels last seen during the peak of the tech bubble.

Yet, as fuel for Lasso-like optimism, investors can find reassurance in the economic fundamentals and solid “hard data” still underpinning the market. Corporate earnings, job data, and spending numbers, for example, continue to come in strong.

In our view, market messaging remains decidedly mixed, reinforcing the need for a balanced approach. Over the coming months, the true impact of tariffs should become clearer. This may ultimately guide our positioning. We will be, ready, as matters become clearer, to increase exposure if a global bull market emerges, stay balanced in a range-bound market, or reduce risk if current optimism proves premature.

Sometimes the best advice is the simplest: believe but verify. Stay optimistic about the long-term while keeping your strategy flexible.

Sell in May? Not This Year

After the rollercoaster ride of March and April, May’s market rebound felt like stepping off a treadmill after a grueling workout—relief mixed with satisfaction. Global markets found their footing, volatility took a welcome break, and investors' heart rates finally returned to normal. Or maybe that was just me?

So, how exactly did we suddenly pivot to optimism when trade tensions have not been fully resolved? The answer, much like Ted Lasso’s coaching philosophy, unfolds in layers.

First, trade tensions noticeably eased, giving markets a substantial boost. Investors breathed a collective sigh of relief when President Trump temporarily backed off imposing massive tariffs on Chinese imports, signaling openness to further dialogue. Adding to market relief was Trump's move to postpone hefty 50% tariffs on the EU. If nothing else, this showed markets that diplomatic channels remain very much open. Throw in promising trade talks with India, and its clear markets saw a positive trend developing.

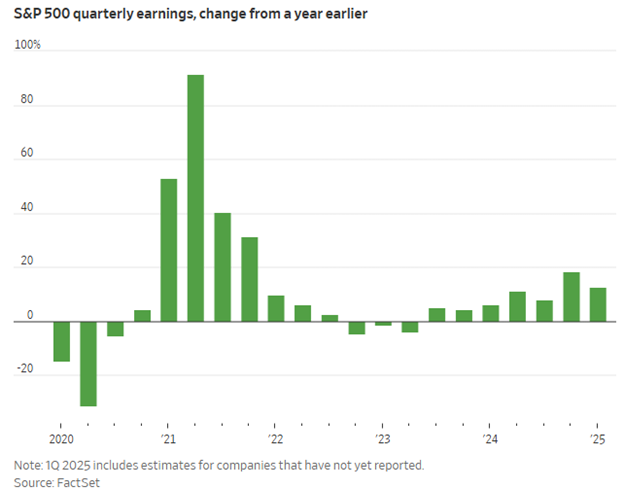

Second, corporate earnings painted a reassuring picture. According to Strategas, first-quarter profits surged an impressive 13% year-over-year—a stellar performance amid tariff concerns and recession fears. The performance shows how adaptive companies can be. It echoes legendary basketball coach John Wooden's famous quote: "Things turn out best for the people who make the best of the way things turn out." Let’s hope this trend continues.

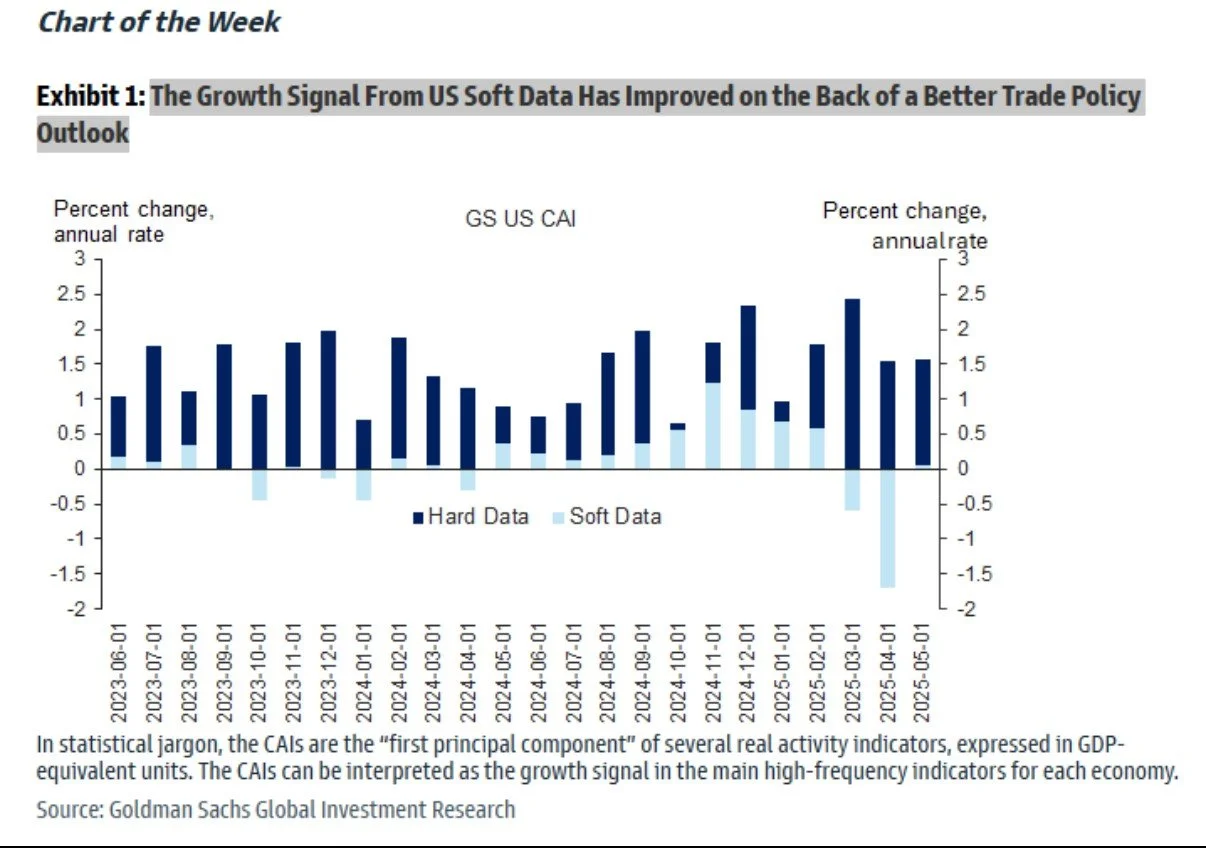

Third, the economy showed impressive resilience. Solid economic metrics and a clear rebound in consumer confidence suggested a brighter, more secure mood among consumers—crucial for ongoing market growth. All year, hard data (objective, quantitative measures) have been consistently strong. It’s the soft data (subjective, survey-based indicators) that lagged—until May. Goldman Sachs highlighted this clearly, showing a marked improvement in soft data.

Like the weather, the vibes in May got much better.

Last month also revamped the "Magnificent Seven" trade. Those goliath tech companies, like Nvidia and Tesla, surged and became powerful drivers of the broader market upswing. More on this in the next section. Consumer discretionary stocks also thrived, particularly after the U.S. and China agreed to temporarily reduce tariffs, boosting sentiment.

All of this has helped ease recession fears and encouraged investors to move back into riskier assets. The job market is still holding up well, inflation keeps trending downward (at least for now), and there's cautious optimism building around potential tax cuts. Throw in growing expectations that the Fed might start cutting interest rates soon, and you've got a pretty solid recipe for why stocks climbed last month.

On Big Tech Earnings

I wanted to pause here.

Of all the events that transpired last month, Big Tech earnings season was a big one. Not to put so much pressure on one sector, but Big Tech's story has become intertwined with the greater market. It's hard to recall a time when so many investors were so laser-focused on the earnings of a handful of tech giants.

I suppose, as goes Rome, so goes the world.

Here's how we see it: a strong tech sector means three critical things are still working:

1) AI continues to grow, justifying the hype

2) Companies are opening their wallets (hello CAPEX!)

3) US tech dominance is alive and well

So, is the story still intact? After the latest numbers from the major players, absolutely.

Big Tech’s most recent earnings report was very impressive when you consider the curveballs they've been dealing with. These companies, across the board, have been wrestling with some serious headwinds from U.S. export restrictions on China. Nvidia, for example, even disclosed writing off a ho-hum $4.5 billion worth of H20 chip inventory. Even worse, they estimated another $2.5 billion in lost revenue from these same restrictions. That's real money walking out the door – a perfect example of how tariff moves hit actual balance sheets.

Even with all this chaos, the tech giants crushed Wall Street expectations and had the confidence to guide for robust growth ahead. That's not just wishful thinking, that's putting your money where your mouth is.

The main driver here was continued demand for AI infrastructure and cloud services, which are essential for advanced AI models. Companies are still spending big on digital transformation. Every enterprise trying to build the next breakthrough AI application needs this infrastructure, and Big Tech owns that playground.

From a market perspective, Big Tech's stellar performance was a much-needed jolt to both the sector and the market. The latest earnings prove that even in a world full of geopolitical noise and supply chain headaches, innovation and execution still win the day.

So Big Tech is crushing it, the sector is booming, and AI spending is through the roof. But here's the trillion-dollar question everyone's asking: does this tech strength mask broader economic weakness?

Let's talk about the R-word.

Do We See a Recession?

This is still the question we get most often.

From our humble perch, recession risk has decreased considerably over the last month. We're not alone in this thinking. Here's a chart from Polymarket reflecting betting odds of a 2025 recession. These fears spiked to 60% in April but have settled back to 32% today—a little above normal, but nothing alarming.

Source: Forbes, Glenview Trust, Bloomberg

Here's the thing: Historically, U.S. recessions rarely happen unless company profits fall first. It's a domino effect: profits drop, then everything else follows.

So, after everything markets have had to deal with, where do we stand?

Corporate profits slipped last quarter (hence the jitters), but per Strategas, they're still up a solid 5.5% year-over-year. That's healthy growth when you look at the big picture.

Sure, there's uncertainty ahead. We've got potential headwinds like tariffs squeezing profits, but also likely cushions coming. It's basically a giant tug-of-war. If profits stumble, everything follows fast: companies stop buying equipment, freeze hiring, and slash marketing budgets. The whole economy pulls back.

Right now, corporate profits are still trending up despite first-quarter wobbles. The key for policymakers? Keep that profit growth alive after all the policy changes shake out. It's really that simple: keep profits growing to keep a recession at bay.

What Could Bring Profits Down?

In a word? Uncertainty.

For businesses to make bold, billion-dollar investments, they need a sense of stability. When conditions are murky—policy shifts, tariff uncertainty, geopolitical tensions—many companies hit the brakes. Spending stalls, hiring freezes, and expansion plans are paused.

One of the tools we watch closely for signs of business sentiment is the ISM Manufacturing Survey. It's a helpful pulse check on how U.S. manufacturers are feeling about orders, hiring, inventories, and overall activity. The most recent survey painted a pretty cautious picture. Here are a few standouts:

Primary Metals Mfg: “We have entered the waiting portion of the wait and see, it seems. Business activity is slower and smaller this month. Chaos does not bode well for anyone, especially when it impacts pricing.”

Chemical Mfg: “Decision-making remains extremely difficult due to extreme tariff uncertainty.”

Furniture & Related Product Mfg: “Business Sucks.”

Well, you get the point.

This kind of feedback underscores one of our bigger concerns: Are markets underestimating the real-world impact of tariffs and policy friction? Sure, a handful of tech giants continue to deliver impressive results, but it’s fair to ask, how long can standout performance from a few companies offset broader uncertainty?

Nvidia remains a great example. While they’ve continued to outperform, they've also absorbed billions in losses tied to export restrictions. That’s not insignificant—and it shows how policy headlines can quickly affect financial performance.

Consumers may be feeling the effects too. Former Trump advisor and Goldman Sachs exec Gary Cohn recently pointed out that tariff-related inflation may already be trickling down into the checkout aisle. Anecdotally, our team has noticed some surprising price jumps on everyday items (your next Best Buy run might reveal the same).

Chart of the Month: This great chart from Strategas represents our number one concern for stocks. Based on just about every valuation metric, the S&P 500 is expensive. Not a reason to sell, but an argument for balance and diversification.

One More on our Radar: Here is a survey we would like to see reversed and fast.

Allocation Update

Recession risks have diminished, prompting strategic adjustments across client portfolios. While we've added a measured dose of offense to our positioning, we remain committed to maintaining balance and flexibility in the current environment.

June should be quite eventful for markets.

Here's what's on our radar:

· Early June: Senate tax bill deliberations

· June 15-17: G-7 Summit (trade deals?)

· June 16: liquidity drain begins (Taxes, Repo)

· June 17: Bank of Japan policy meeting

· June 17-18: Federal Reserve meeting

· Mid to late June: Potential appeals court on tariffs

This event-heavy month reinforces our preference for balanced positioning over high-conviction bets. Tariff clarity should emerge over the summer, helping us decide whether to increase exposure in a broadening bull market, maintain balance in range-bound conditions, or reduce risk if optimism proves overdone.

Recent portfolio activity reflects evolving market dynamics. Following Big Tech’s impressive earnings results, we have increased confidence in growth stocks. We have maintained a preference for select value opportunities, particularly in banks and energy (with nuclear-related stocks showing notable momentum), while acknowledging the market's renewed focus on tech and the Magnificent Seven.

Also, the "Big, Beautiful Bill" currently working through Senate channels remains a wildcard. While we doubt it passes as written, the appetite for increased spending and deficit expansion is clear. History suggests such fiscal moves may lift equities and gold while pressuring bonds. We'll communicate any positioning changes as this develops.

Here's where we stand:

Equities – Balanced:

International Balance: While still light in emerging markets, we added to developed international earlier in the year and have maintained that balance.

Developed International: The trend continues, as developed equities are outpacing the S&P 500 by 16% (Koyfin), despite tariff noise.

Fixed Income – Slightly Underweight:

Core Bonds: We remain balanced and are taking a “wait and see approach” regarding tilting towards short or longer dated bonds. Rising rates are not encouraging.

Floating-rate Bonds and CLOs: Yields remain strong and are a nice hedge against the possibility of higher rates.

Alternatives – Overweight

Gold Overweight: Gold continues to perform well and serves as a nice hedge against inflation/dollar risk.

Growing Interest in Private Alternatives: Where applicable, our team expects to utilize private investments more meaningfully moving forward.

Cash – Overweight (but decreased)

Strategic Use of Cash: Cash continues to offer valuable stability and flexibility while still delivering yields above 4%.

One of my favorite Ted Lasso moments is when he tells Sam, a player who overthinks everything, to "be a goldfish." Why? Because goldfish have a 10-second memory—the perfect reminder to bounce back quickly from mistakes.

That's become our family motto lately. Baby Ellie is thriving at nearly three months old, but our "defense" against the older boys has ... well, let's just say it needs work. Throw in potty training chaos and believe me when I say that Heather and I have seen some things.

But like good little goldfish, we shake it off and swim on.

Our next newsletter will splash into your inbox mid-July, hopefully finding you busy with the best kind of summer celebrations.

As always, reach out if you’d like to revisit your portfolio before the summer kicks off into full gear.

Kyle M. McBurney, CFP®

Managing Partner

CRN202806-8861133

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Supervisory office: 280 Congress Street, Boston, MA 02210. (617)-439-4389. Highland Peak Wealth is not a subsidiary or affiliate of MML Investors Services, LLC or its affiliated companies. Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. This material does not constitute a recommendation to engage in or refrain from a particular course of action. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index.

Glossary of Index Definitions

Indexes are unmanaged, do not incur fees or expenses, do not reflect any deduction for taxes, and cannot be purchased

directly by investors.

The S&P 500® Index is a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

The S&P Muni Bond Index is a broad, market value-weighted index that seeks to measure the performance of the U.S. Municipal bond market.

Dow Jones Industrial Average is a price-weighted average of 30 actively traded Blue Chip stocks, primarily industrials, but also including other service-oriented firms; may be used as a benchmark for large cap stocks

NASDAQ Composite is a broad-based index of over 3,000 companies, which measures all domestic, and non-U.S.-based common stocks listed on the NASDAQ Stock Market, Inc.

The NASDAQ 100 U.S. Index is a composed of the 100 largest, most actively traded U.S. companies listed on the Nasdaq stock exchange.

The Russell 2000® Index is a widely recognized, unmanaged index representative of common stocks of smaller capitalized U.S. companies.

The MSCI EAFE Index is a widely recognized, unmanaged index representative of equity securities in developed markets, excluding the U.S. and Canada.

The MSCI Emerging Markets (EM) Index is an unmanaged market capitalization-weighted index of equity securities of

companies domiciled in various countries. The Index is designed to represent the performance of emerging stock markets

throughout the world and excludes certain market segments unavailable to U.S.-based investors.

The MCSI All Country World Index (ACWI) captures large and mid cap representation across 23 Developed Markets and 24 Emerging Markets.

The Barclays U.S. Aggregate Bond Index is a broad measure of the U.S. investment-grade fixed-income securities market.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of fixed-rate investment-grade securities with at least one year to maturity, combining the Bloomberg U.S. Treasury Bond Index, the Bloomberg U.S. Government-Related Bond Index, the Bloomberg U.S. Corporate Bond Index, and the Bloomberg U.S. Securitized Bond Index.

The Nikkei Index is a price-weighted index composed of Japan’s top 225 blue-chip companies traded on the Tokyo Stock Exchange.

©2023 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its

content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information