July & August 2025 - Halftime Adjustments

Kyle M. McBurney, CFP

Managing Partner at Highland Peak Wealth

“We just stuck with our plan, played our game, and trusted each other. You have to keep your composure and focus on the next play — that’s what winning teams do.”

Tom Brady

Atlanta Falcons fans, look away.

In the late winter of 2017, I was still very much a newcomer to Boston, figuring out the quirks of a new city. There's a saying here that if you weren't born here you're always a tourist. That is an exaggeration, but in Boston, it is more than anywhere else. Town names still trip me up.

Tourist or not, in early '17, you couldn't miss the buzz around the Patriots dynasty. Super Bowl LI against the Atlanta Falcons was supposed to be a victory lap with Brady, Belichick, and company adding another ring to the collection. But the first half of the Big Game didn't follow the script.

Down 28–3 late in the third quarter, it looked like the Patriots were finished. A 25-point deficit in the Super Bowl? No team had ever come back from anything near that. It would have been easy, maybe even expected, to abandon the plan and try something desperate.

But that's not what happened.

There was no fiery rah-rah halftime speech. No panic. Just quiet focus. The Patriots made a few small adjustments, picked up the tempo, got the running backs more involved, and stuck to their identity and plan. No trick plays. Just disciplined execution.

What followed was one of the greatest comebacks in sports history. Maybe the greatest. I try not to be too biased, even as a Boston transplant.

Good investing, like good football, rarely calls for heroics. When headlines scream and markets swing, it's tempting to act boldly. But more often, patience and discipline win the day.

The first half of 2025 certainly tested that.

Markets were rocked after "Liberation Day," with U.S. stocks shedding trillions in value within days. The Dow dropped nearly 1,700 points between April 2nd and 9th. The S&P and Nasdaq fared even worse. The selloff didn't stop there—the dollar slid, oil dropped, and even gold lost ground. It was one of those moments that made you want to do something. Anything.

We did act, of course, but like the Patriots, our adjustments were modest. We leaned slightly more into international equities, focused on alternatives, and held additional dry powder. No overhaul. Just thoughtful, deliberate moves to stay prepared for multiple outcomes.

The rebound, as we know, was historically swift. The S&P 500 roared back at record velocity - the fastest bounce back since 1982, per Bloomberg. A fresh reminder of how tough it is to time both the exit and, more challenging still, the reentry.

Now, as we enter the second half, signals remain mixed. Tariffs, fiscal expansion, stretched valuations, and strong momentum are all in play. The latest AAII survey shows a near-even split between bulls and bears. Markets could break higher or run into trouble. In other words, this is a completely normal market.

That's why we're staying flexible. We're ready to lean in if global breadth improves and the bull case strengthens. We remain focused on monitoring market signals and maintaining a balanced approach. After all, the first half was a rollercoaster. Maybe the second half brings a breather. But this is 2025 and I wouldn't bet on it. Halftime is a good time to catch your breath, not change your identity.

An Objectively Good Start

Unlike the Hokey Pokey, tariffs are not what markets are all about.

Yes, the “Liberation Day” tariffs made early headlines. But as the old saying goes—even the circus has more than one act.

Trade tensions and geopolitical flare-ups made plenty of noise, but underneath it all, markets delivered more upside than most people expected. Stocks around the world continue to recover from the April swoon. For globally diversified investors, there was even more to be satisfied with. From our seat, here’s what really helped drive returns:

The scorecard for the first half of 2025 reads "better than fine." More importantly, diversification demonstrated its enduring value.

For the first time in years, meaningful returns came from outside U.S. markets. International stocks played a starring role, gold stayed golden, and high-quality bonds smoothed the inevitable bumps. While the S&P 500 experienced its sharp April drawdown, portfolios with a healthy mix of international exposure felt considerably less pain.

Of course, 2025 still has six months to unfold. Channeling my inner Ted Lasso (via Aristotle): well begun is half done. Earnings season continues in earnest, tariff policies remain fluid, and economic data keeps arriving in mixed batches. Yet the market has pushed steadily higher, methodically climbing that proverbial wall of worry.

Will the market’s current calm last?

Looking Ahead: No Bold Predictions

So here we are, at the beginning of the second half of the year with markets pushing toward all-time highs and plenty of questions still hanging in the air.

Yes, the One Big Beautiful Bill Act (OBBB) is massive. And yes, trade negotiations with China continue to be kicked down the road. But markets are forward-looking machines and they’ve already digested a lot of this noise. So rather than make bold predictions, we’re focused on a few key themes that could drive the next chapter [half?]:

Q2 Earnings – Can companies justify their valuations?

Fed Messaging – Will we finally see a path to rate cuts if inflation data improves?

Market Breadth – Can this rally broaden beyond the same few mega-cap names? Will small-cap stocks finally join the party?

Expect future editions to dig deeper into these themes as the answers unfold. But here’s the bottom line: if the market doesn’t get good news on #1 and #2, it may be hard for U.S. stocks to maintain this pace. If that’s the case, we’ll likely be leaning even further into international opportunities.

The Continued Case for International Stocks

"Why do I even own international stocks? U.S. companies seem to do better."

That frustration made perfect sense—U.S. stocks dominated for most of the last decade. But 2025 has flipped the script, with international markets delivering double-digit gains while U.S. stocks managed only modest returns.

So what has changed? Two key factors stand out.

1) U.S. Dollar Weakness

The U.S. dollar is off to its worst start in decades—and that's creating opportunities for investors.

A weaker dollar helps U.S. companies that sell overseas and earn foreign revenue. When those earnings get converted back to dollars, they're worth more. But it also makes imports pricier, which can fuel inflation.

For investors, though, the real story is how this benefits international stocks. When you buy a European stock, you're essentially buying euros. As the dollar weakens, those euros become more valuable—boosting your returns even if the stock price stays flat.

The numbers tell the story. While the S&P 500 gained a solid 6% in the first half of 2025, developed international stocks surged 19.45%. Emerging markets weren't far behind at 15.27%.

This follows a familiar pattern: strong dollar periods favor U.S. stocks, while weak dollar periods—like now—tend to favor international markets. A continued weaker dollar could provide a tailwind for international stocks, though currency trends remain unpredictable.

2) Market Valuations

International markets also remain much cheaper than U.S. stocks—a gap that's been widening for years. While U.S. stocks typically trade at higher valuations, the current spread has many asking: at what point do international stocks become too cheap to ignore?

Major firms seem to think that point is now. Long-term outlooks from Vanguard, Goldman Sachs, and J.P. Morgan suggest international stocks are likely to outperform over the next decade, driven partly by expectations for continued dollar weakness.

Beyond valuations, international exposure offers something equally valuable: diversification. It spreads risk across different economies and industries, reducing your portfolio's dependence on U.S. mega-cap stocks.

This year proves the point perfectly. While many investors have been overweight U.S. stocks for years, international markets are having their moment, delivering nearly triple the returns of the S&P 500, per Morningstar Direct.

The lesson? Diversification works, even when it requires patience. Different regions take turns leading, but a globally balanced portfolio tends to weather volatility better over time.

Speaking of Valuation

U.S. stocks recently closed on June 30th at 23x future earnings, per Factset, approaching bubble territory.

The S&P 500's price-to-sales ratio is about as high as its ever been, as noted by the Leuthold Group.

Meanwhile, according to Bloomberg, the equity risk premium on June 30th, which measures the extra return stocks provide over Treasuries, sits at just 2.16% (the lowest since 2002).

The theme is clear: U.S. stocks are expensive by almost any measure.

As risk managers, we can handle volatility. Recent downturns in 2020, 2022, and early 2025 rewarded patient investors who weathered the storms. But what if markets get stuck in neutral for years? Despite market history suggesting otherwise, investors have grown accustomed to above average market returns.

I hate the term lost decades as it's an arbitrary timeframe, but the 2000-2009 period tells the story perfectly.

At these elevated multiples, the math gets challenging. Vanguard Capital Markets Model® recently downgraded their 10-year outlook for U.S. stocks to just 4.8%. Goldman Sachs holds a similar view.

Our job is ensuring that a repeat of the 2000s—when stocks went nowhere for a full decade—doesn't derail long-term investment plans.

Rather than hoping for the best, we're focusing on what else can potentially drive portfolio growth:

Can international stocks play a larger role?

With much cheaper valuations and strong recent performance, they offer compelling diversification.

Where are the pockets of growth?

Continued interest in AI, healthcare technology, and energy infrastructure may provide meaningful upside opportunities.

What role can private alternatives play?

With only 10% of companies trading publicly, a focused approach to private markets could help offset potential public market disappointments.

High valuations don't guarantee poor returns, far from it, but they do suggest we need to be more creative about where we find future growth. The good news? We have more tools than ever before.

Our team at Highland Peak Wealth continues to expand our investment options, including firms such as MassMutual and Fidelity, providing clients access that didn't exist just years ago. Every investment decision remains tailored to individual circumstances, but having these tools ready makes all the difference.

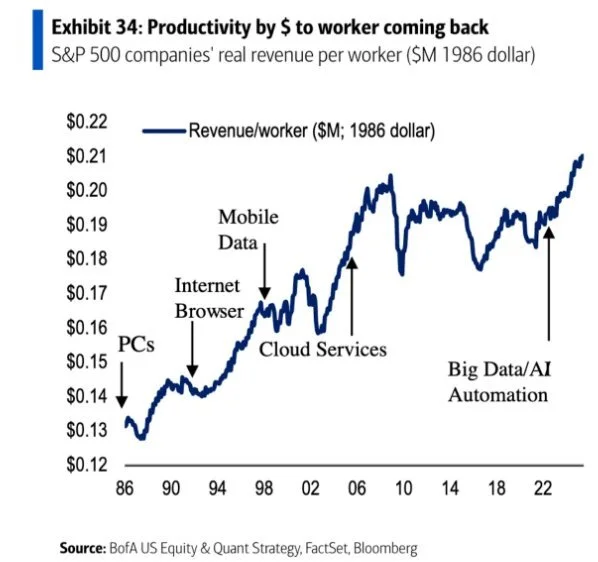

Chart of the Month: Of course, there is always a counterargument: we're all becoming more productive, and AI continues playing a transformative role. If technology truly boosts earnings growth beyond historical norms, perhaps today's valuations aren't as stretched as they appear.

Mid-Year Allocation Update

Markets survived "Liberation Day" without a meltdown. We've gained clarity on tax policy and trade direction, and U.S. markets have responded by pushing back to all-time highs. Optimism is spreading, and while some of it may be moving too fast, the near-term setup still looks supportive.

That said, we're not taking anything for granted.

We remain constructive that equities can continue recent momentum, but we're layering in more cushion for what could be a trickier second half. After all, we're heading into the weakest seasonal stretch of the calendar with plenty of question marks still out there.

So, what are we doing about it?

We're sharpening our focus—leaning into select growth areas like Artificial Intelligence and Energy Transition while building exposure in private markets and diversifying globally.

The dollar's recent slide has been a gift to international investors, especially in emerging markets where commodity demand is surging. We've been tactically underweight here, and that caution served us well. But the environment is shifting, so we're tilting slightly less light. When the dollar weakens, emerging markets benefit, and that dynamic stills shows up in the data.

Fixed income also tells an interesting story. Treasury yields have eased from their highs, but the yield curve remains muted with the 10-year hovering near 4.45% and the 2-year just below 3.90%, per Koyfin as of July 15th. While markets anticipate potential rate cuts, the Fed has yet to signal its direction. We are focused on quality in fixed income while watching for signs of stress if rates stay "higher for longer."

We're sticking with our precious metals positioning, especially gold, as a hedge if volatility resurfaces. We're also noting the continued flow of institutional capital into crypto. Our team is noting how many smart allocators have moved into crypto.

Bottom line: we're optimistic, but not complacent. By staying nimble and disciplined, we aim to make our own luck no matter how the second half unfolds.

Here's where we stand:

Equities – Balanced:

International Balance: More balanced than ever, as global stocks produced tremendous returns in the first half. Valuations remain attractive and the cheaper dollar continues to provide support.

Small Caps: On and off again trend has investors frustrated, but history tells us attractive at these levels of valuation.

Fixed Income – Slightly Underweight:

Core Bonds: We remain balanced and are taking a “wait and see approach” regarding tilting towards short or longer dated bonds. Rates have remain in a tight range.

Floating-rate Bonds and CLOs: Yields remain strong and are a nice hedge against the possibility of higher rates.

Alternatives – Overweight

Gold Overweight: Gold continues to perform well and serves as a nice hedge against inflation/dollar risk.

Growing Interest in Private Alternatives: We continue to explore private investments where appropriate, based on client needs and market access.

Cash – Overweight (but decreased)

Strategic Use of Cash: Cash continues to offer valuable stability and flexibility while still delivering yields above 4% (as of 7.1.25)

We are proud to announce that the Highland Peak Family continues to grow. In more ways than one!

We are THRILLED to announce that Chris Smith has joined our team from MassMutual Trust. For those unaware, Chris is a celebrity within the walls of MassMutual and agencies across the country. Chris brings 20+ years of experience and a very strong track record in the High-Net-Worth world. We are incredibly lucky to have him on the team.

But wait, there's more (Billy Mays voice)! Santo, our tireless Wealth Director, and his wife, Camilla, welcomed a beautiful baby boy to the world on July 14th. His name is Matteo, and he's adorable. Considering my newborns looked like aliens, Matteo is a supermodel in my eyes. He takes after his mama and papa!

Does our team have a baby problem? I say yes!

I joke, of course. Ellie continues to be amazing in every way possible. Having a girl in a sea of little boys has been super special.

From our family to yours, we hope you have a wonderful summer ahead. Cheers to sunny days!

Kyle M. McBurney, CFP®

Managing Partner

CRN202807-9159174

Asset allocation does not guarantee a profit or protect against loss in declining markets. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio or that diversification among asset classes will reduce risk.

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Supervisory office: 280 Congress Street, Boston, MA 02210. (617)-439-4389. Highland Peak Wealth is not a subsidiary or affiliate of MML Investors Services, LLC or its affiliated companies. Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. This material does not constitute a recommendation to engage in or refrain from a particular course of action. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index.

Glossary of Index Definitions

Indexes are unmanaged, do not incur fees or expenses, do not reflect any deduction for taxes, and cannot be purchased

directly by investors.

The S&P 500® Index is a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

The S&P Muni Bond Index is a broad, market value-weighted index that seeks to measure the performance of the U.S. Municipal bond market.

Dow Jones Industrial Average is a price-weighted average of 30 actively traded Blue Chip stocks, primarily industrials, but also including other service-oriented firms; may be used as a benchmark for large cap stocks

NASDAQ Composite is a broad-based index of over 3,000 companies, which measures all domestic, and non-U.S.-based common stocks listed on the NASDAQ Stock Market, Inc.

The NASDAQ 100 U.S. Index is a composed of the 100 largest, most actively traded U.S. companies listed on the Nasdaq stock exchange.

The Russell 2000® Index is a widely recognized, unmanaged index representative of common stocks of smaller capitalized U.S. companies.

The MSCI EAFE Index is a widely recognized, unmanaged index representative of equity securities in developed markets, excluding the U.S. and Canada.

The MSCI Emerging Markets (EM) Index is an unmanaged market capitalization-weighted index of equity securities of

companies domiciled in various countries. The Index is designed to represent the performance of emerging stock markets

throughout the world and excludes certain market segments unavailable to U.S.-based investors.

The MCSI All Country World Index (ACWI) captures large and mid cap representation across 23 Developed Markets and 24 Emerging Markets.

The Barclays U.S. Aggregate Bond Index is a broad measure of the U.S. investment-grade fixed-income securities market.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of fixed-rate investment-grade securities with at least one year to maturity, combining the Bloomberg U.S. Treasury Bond Index, the Bloomberg U.S. Government-Related Bond Index, the Bloomberg U.S. Corporate Bond Index, and the Bloomberg U.S. Securitized Bond Index.

The Nikkei Index is a price-weighted index composed of Japan’s top 225 blue-chip companies traded on the Tokyo Stock Exchange.

©2025 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its

content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information